Gifting Options - Outright Gifts

Gifts of Securities

Gifts-In-Kind

Gifts of Real Estate

Gifts of Life Insurance

Matching Gifts

Memorial or Honorary Gifts

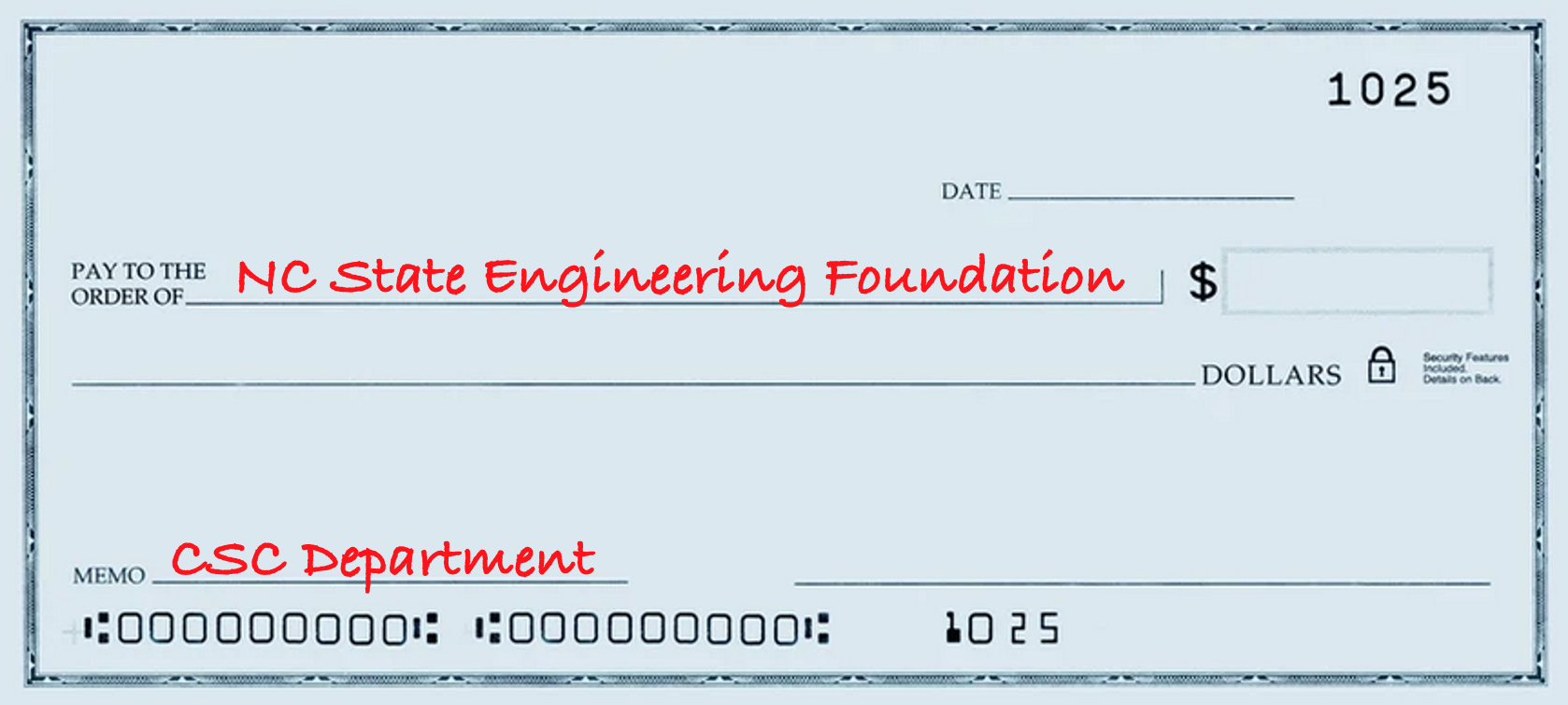

Gifts of Cash

Gifts of cash are the easiest and most direct way to make a gift. Cash gifts can be made simply by writing a check payable to NC State Engineering Foundation, Inc., and sent to NC State University Gifts and Records Management, Campus Box 7474, Raleigh, NC 27695-7474, with the Department of Computer Science in the check memo.

You can also give a gift online with your credit card. The Computer Science Enhancement Endowment is the department's general fund, but you may also want to contribute to one or more specific endowments that are provided on this page for your convenience.

Another option would be providing a gift through your will or living trust in the form of a cash bequest. If you have questions about a will bequest, please contact Sara Seltzer, Direct of Development for the computer science department, at 919-515-3730 or skseltze@ncsu.edu. It is important that you notify us in advance or include instructions telling us which program(s) you would like to support with your will bequest, so we can make the appropriate arrangements to ultimately accept the donation and apply it as you intended. Your charitable deduction will be the value of the gift you make.

Gifts of Securities

Using appreciated securities - stock and bonds - is a popular method of making a gift to the computer science department through the NC State Engineering Foundation. A gift of appreciated securities provides a double tax savings: you can deduct the average of the high/low value of the securities on the date of the gift and totally avoid the capital gains tax on the appreciation.A gift of appreciated securities, held for more than one year, entitles you to a charitable income tax deduction in the year you complete the gift. You can use the deduction to offset up to 30% of your adjusted gross income. Any deduction exceeding the 30% limit is carried forward for up to five additional years. You may also donate securities you have held for less than one year, but your deduction will typically be based on what you paid for the securities.

Publicly traded securities can fund all types of gifts - everything from annual gifts for current operations to major gifts or even a life income gift. More and more donors are transferring publicly traded shares to the Engineering Foundation electronically. Mutual funds are also transferable as well, but can take much longer to complete as the transfer requirements vary significantly from fund to fund.

Stock Transfer Instructions (PDF document)

Gifts-In-Kind

Gifts of property such as equipment, paintings or other art objects can be donated to the computer science department and entitle you to an income tax deduction. Because items of this nature are subject to estate tax, a donation, either during your lifetime or as a bequest under your will, may also produce estate tax savings.For gifts made during your lifetime, the amount of the deduction depends on whether the gift relates directly to NC State's educational activities and purposes. This "related-use" restriction does not apply to gifts made through a bequest under your will or living trust. Donors can deduct the full fair market value of the property provided they have owned the assets for at least one year and the gift satisfies the "related-use" requirement. With property owned for less than twelve months, the deduction is limited to the price paid for the property.

Gifts of Real Estate

A gift of real estate can include a gift of a principal or vacation residence, farm, timberland, commercial buildings or unimproved land and can be for the entire property or a fractional interest. Gifts of real estate entitle you to the same tax benefits as gifts of appreciated securities, provided you have owned the real estate for more than one year and there are no liens on the property. The donor is entitled to a charitable income tax deduction of the full fair market value of the real estate, valued at the time of the gift. Additionally, the donor will avoid capital gains tax on the transfer. Gifts of real estate can also generate substantial estate tax savings by removing a high-value asset from your estate. Appreciated real property is also an excellent asset to use to establish a charitable remainder trust.Since your home or property may be your most valuable asset, you may want to consider a gift of a remainder interest in your property instead of an outright gift. A gift of a remainder interest allows you to continue to enjoy your home for your lifetime, and the lifetime of your spouse, while providing a current charitable income tax deduction and potentially lower estate tax costs. See the retained life estate topic under the planned giving section.

Because the ability to market the property is a major consideration in the NC State Engineering Foundation's acceptance of a gift of real estate, we invite you or your advisor to call us to discuss such a transfer.

Gifts of Life Insurance

Naming the NC State Engineering Foundation as owner and irrevocable beneficiary of the policy will generate an income tax deduction for the donor. The charitable deduction will depend on several factors including what, if any, premiums are still to be paid. This can be a cost efficient way to provide a significant gift in support of the Department of Computer Science at NC State's College of Engineering.You may also designate the NC State Engineering Foundation as the beneficiary, or contingent beneficiary of your group term life insurance through your employer, noting the department as the recipient of your gift. This method of giving will not generate a current income tax deduction, but it will remove the value of the insurance from your estate. Your human resources division can assist you with making such a designation on your group term policy.

Matching Gifts

An excellent way to leverage your gift to the department, through the NC State Engineering Foundation, is to ask your human resources department if your employer will match your gift through their matching gift program. By following the guidelines established by your employer, your gift could be doubled or even tripled. This benefit is often available to the spouse of the employee as well as to retirees and board members.Gift credit is given to both the donor and the company when a matching gift is received. These gifts are also factored into the calculation for the donor's placement in the University Lifetime Giving Societies.

Matching Gift Company Information

Memorial or Honorary Gifts

A gift made in memory or in honor of a family member, friend, student or teacher is a generous way to memorialize the individual's life, accomplishments and association with the computer science department at NC State.

We notify the honoree or their family of the names and the addresses of those making the gift. Please forward with your gift the name of the person being honored and their address or that of their next of kin if possible.